The Acorns app helps you save and invest money automatically without extra effort.

By rounding up your everyday purchases, you turn spare change into investments that grow over time.

This guide will show you how Acorns works and how you can use it to build consistent savings with minimal effort.

What Is the Acorns App?

The Acorns app is a micro-investing platform that helps you automatically save and invest spare change from your everyday purchases.

It’s designed to make saving simple by turning small amounts into long-term investments based on your financial goals.

How Acorns Automatic Savings Works

Acorns makes saving effortless by using automation tools that invest for you in the background.

Each feature is designed to help your money grow consistently without requiring daily effort.

- Round-Ups: Acorns rounds up your purchases to the nearest dollar and invests the spare change.

- Recurring Investments: You can schedule automatic deposits daily, weekly, or monthly.

- Found Money: Earn cash-back rewards from partner brands when you shop through Acorns.

- Smart Deposit: Automatically invest a percentage of each paycheck.

- Earn Feature: Get bonuses for using linked debit or credit cards at selected retailers.

Setting Up Your Acorns Account

Getting started with Acorns only takes a few minutes.

You’ll need to create an account, link your bank account, and choose your investment preferences to start saving automatically.

- Download the App: Get the Acorns app from Google Play or the App Store.

- Create Your Account: Sign up with your email and verify your identity.

- Link Your Bank Account: Connect your checking account securely for deposits and round-ups.

- Select Investment Preferences: Choose your risk level and savings goals.

- Start Investing: Confirm your first investment to activate your automatic savings.

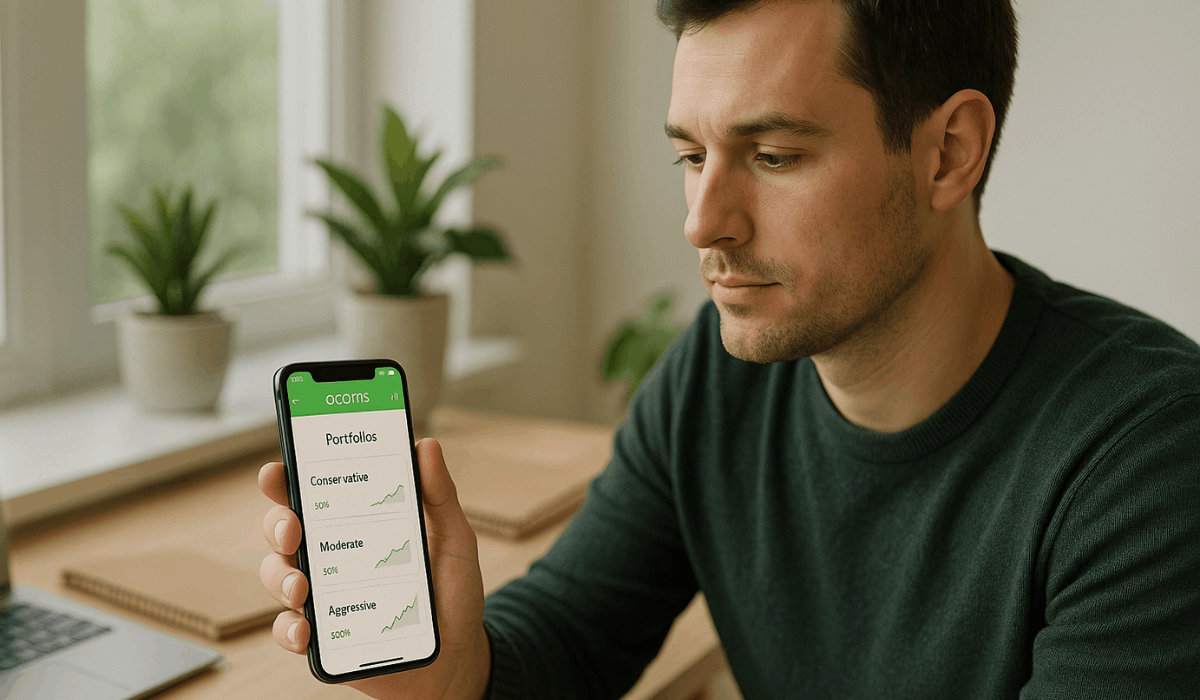

Acorns Investment Portfolios Explained

Your savings are placed into professionally managed portfolios designed to match your financial goals.

Each option varies by risk level and growth potential, giving you control over how you invest your money.

- Conservative: Prioritizes safety and steady income with mostly bond investments.

- Moderately Conservative: Offers a cautious mix of bonds and stocks for gradual growth.

- Moderate: Balances stability and opportunity with equal parts stocks and bonds.

- Moderately Aggressive: Focuses more on stocks for higher returns while keeping some stability.

- Aggressive: Targets long-term growth by investing heavily in stocks with higher market exposure.

Key Features That Boost Your Savings

The platform includes several built-in tools that make saving and investing more efficient.

Each feature is designed to help you build wealth automatically and stay consistent with your goals.

- Earn: Receive cash-back from partner brands and reinvest the rewards automatically.

- Later: Open a retirement account (IRA) to prepare for long-term financial goals.

- Early: Set up investment accounts for your children to start saving for their future.

- Checking: Access an all-in-one checking account linked directly to your investments.

- Smart Deposit: Automatically transfer part of your paycheck into your investment account.

- Round-Ups: Automatically round up purchases to the nearest dollar and invest the spare change.

- Recurring Investments: Schedule daily, weekly, or monthly deposits to build your savings habit.

- Found Money: Earn bonus investments when you shop with participating retailers.

- Grow Magazine: Get financial education and tips inside the app to make smarter money choices.

- Automatic Rebalancing: Keeps your portfolio aligned with your selected risk level.

Tips to Maximize Savings With Acorns

You can get more out of the platform by using its tools strategically.

These simple habits help you grow your balance faster and make the most of every feature.

- Activate All Round-Ups: Turn on automatic round-ups for every purchase to invest spare change consistently.

- Use Found Money Partners: Shop through partnered brands to earn extra cash-back that’s added to your investments.

- Set Recurring Deposits: Schedule weekly or monthly contributions to build savings without effort.

- Reinvest Dividends: Allow earned dividends to be reinvested for compounding growth.

- Review Your Goals Regularly: Check your investment goals and adjust them as your needs change.

- Enable Smart Deposit: Automatically send a portion of each paycheck into your investment account.

- Stay Consistent: Avoid frequent withdrawals to let your money grow in the long term.

- Use Grow Magazine: Read financial tips inside the app to stay informed and motivated.

Pros and Cons of Using Acorns

Here are the main advantages and disadvantages of using Acorns. This will help you decide if it suits your savings strategy.

Pros:

- Easy for beginners: Acorns automates investing small amounts and rounds up purchases.

- No minimum investment required: You can start with very little money.

- Multiple features: Includes savings, investing, retirement accounts, and custodial accounts for kids.

- Diversified portfolios managed for you: Acorns offers different risk levels automatically.

- Cash-back/bonus features: You can earn extra when shopping with selected partner brands.

Cons:

- Flat monthly fees: Can reduce returns if your balance is small.

- Limited control: You can’t pick individual stocks or make advanced trades.

- Fewer advanced tools: Lacks options like tax-loss harvesting and wider asset classes.

- Cost vs. value: Not ideal for significant goals or experienced investors.

Is Acorns Safe and Worth It?

Here are key points to help you decide if Acorns is safe and worth using. They cover how your money is protected and whether the service provides good value.

- Regulation & Oversight: Acorns is SIPC-insured and operates under strict U.S. securities regulations to protect investors.

- Deposit Insurance: Partner banks insure checking funds up to $250,000 per depositor.

- Encryption & Account Security: The app and website use 256-bit SSL encryption; account alerts and automatic log-outs are standard.

- Investment Risk Reminder: Investing always carries risk—market losses can happen, and insurance coverage does not protect against declines in value.

- Fee Consideration: For small account balances, the flat subscription fees may represent a high percentage of your assets, reducing value.

- Best Fit: Works best for beginners who want easy, automated saving and investing, but not ideal for advanced users seeking more control.

How to Withdraw or Access Your Savings

You can pull funds from your account when needed, following a few straightforward steps. Understand the process and any limits or fees before you request a withdrawal.

- Log in to your Acorns account and go to the “Invest” or “Withdraw” screen.

- Select the amount you want to withdraw and choose the bank account you linked for the transfer.

- Confirm your withdrawal and submit the request.

- Be aware of tax implications: if you withdraw gains from your investment account, you may owe taxes.

- For retirement accounts (IRAs) or similar accounts, early withdrawals may trigger penalties or additional taxes.

Conclusion: Start Saving Automatically With Acorns

Using the Acorns app makes it easy to build consistent savings through automation and smart investing tools.

Its features help you save effortlessly, even if you’re starting out.

Download Acorns today and start growing your money automatically.