With the John Lewis Credit Card, you earn points at John Lewis and Waitrose, with vouchers sent to you during the year.

You can check eligibility online in minutes with a soft search that does not affect your score.

Who Issues the John Lewis Credit Card and How it Works

John Lewis Finance Limited is a credit broker, not a lender. NewDay Ltd is the lender and card issuer.

You earn double points at John Lewis and Waitrose for your first 60 days as a new cardholder.

After that, standard earn rates apply. You typically earn 5 points per £4 at John Lewis and Waitrose and 1 point per £10 elsewhere.

Points are converted into John Lewis/Waitrose vouchers, typically £5 for every 500 points, which are sent automatically several times a year.

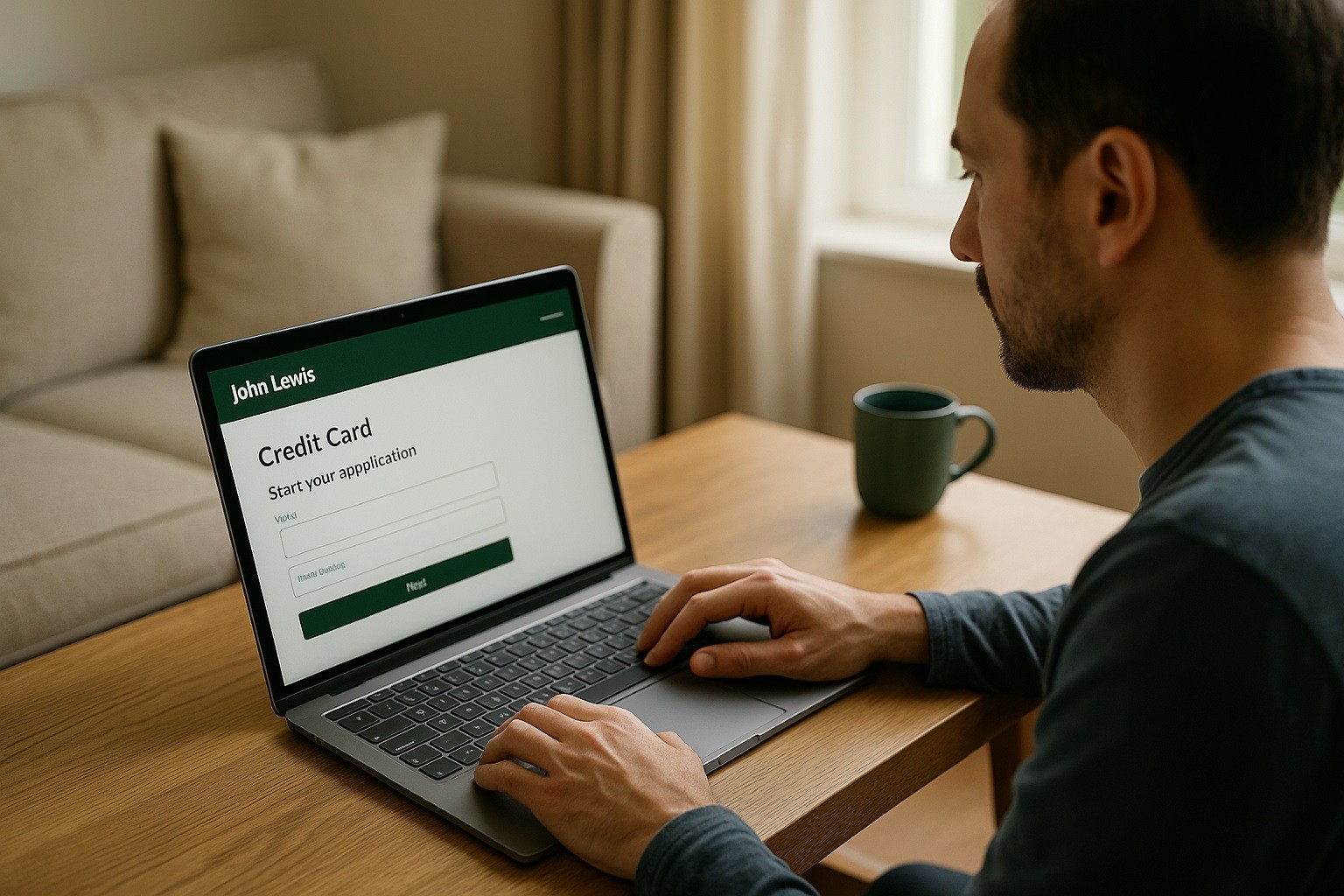

How to Apply for a John Lewis Credit Card

You must be 18 or older, a UK resident, and pass credit and affordability checks. You need 12 months of UK address history.

You need a UK mobile number and an email address. You should not have held a Partnership Credit Card in the last 12 months as a new applicant.

Have your income and employment details ready.

1) Check your eligibility

Use the online eligibility checker first. It uses a soft search and leaves your credit score unchanged.

You will see your likelihood of approval. This helps you avoid a blind application.

2) Start the full application

Proceed only if the checker shows a positive result. You will consent to a hard credit search.

You will provide identity, address, and income details to NewDay. Be accurate and consistent to avoid delays.

3) Enter personal and contact details

Provide your full legal name, date of birth, and 12 months of UK address history. Add your UK mobile and email.

Enter your employment status, income, and monthly commitments. These inform your credit limit and APR band.

4) Review key documents

Open and read the Summary Box. Check the representative APR, purchase rate, cash fees, foreign fees, and default charges.

Check whether there is a 56-day interest-free period on purchases when you clear your statement in full and on time.

Confirm any promotional earn rates or instalment options.

5) Agree and submit

Review the Credit Agreement and pre-contract information. Confirm how payments are allocated and how rates can change.

Submit your application for a decision. You may be asked for extra verification.

6) Set up your account

If approved, download the John Lewis Credit Card app. Set a Direct Debit to avoid missed payments.

Add the card to Apple Pay or Google Wallet if you wish. Monitor your points and statements in the app.

Interest Rates, Fees, and Key Charges

Your APR, credit limit, and offers depend on NewDay’s assessment. Always read the latest Summary Box and Credit Agreement before you apply.

- Representative APR: 29.9% variable (your actual APR may differ based on status).

- Purchase rate: 29.95% p.a. variable (about 2.207% monthly) at the representative tier.

- Higher APR band: some customers may receive a higher variable APR band (example up to about 45.9% APR).

- Balance or money transfer fee (if offered): typically up to 5% of the amount transferred.

- Cash transactions: 3% (minimum £3); check for any scheduled changes and always verify current fees before use.

- Foreign usage fee: Using John Lewis credit card abroad typically around 2.75%–2.95% of the transaction value; confirm the exact rate in your Summary Box.

- Default charges: £12 late payment, £12 overlimit.

- Paper statement copy: usually £3 per request.

- Interest-free period on purchases: up to 56 days when you pay your statement in full and on time; none for cash or some instalment plans.

Managing Your Account After Approval

Use the app or online account manager to track points, see transactions, and download statements.

Set alerts so you do not miss due dates. A Direct Debit for the full statement balance protects your interest-free days on purchases.

If you pay late, you may incur a £12 fee, lose promotional rates, and see a negative impact on your credit file.

Use the app’s secure chat or help centre if you need support with John Lewis credit card points.

Contact Details You May Need

App, login, or account help (24/7): 0333 220 2531 (from abroad +44 333 220 2531).

Money worries team: 0330 175 9829.

John Lewis Finance Limited (registered office): 1 Drummond Gate, Pimlico, London SW1V 2QQ.

NewDay Ltd (registered office): 7 Handyside Street, London N1C 4DA.

Competitors

Here’s a clean side-by-side so you can judge the John Lewis Credit Card against close UK rivals.

| Card (issuer) | Rewards at own store | Rewards elsewhere | Rep. APR (variable) | Annual fee | Notable points |

|---|---|---|---|---|---|

| Partnership John Lewis Credit Card (NewDay) | 5 points per £4 at John Lewis & Waitrose (double for first 60 days for new customers) | 1 point per £10 from 1 Aug 2025; vouchers: £5 per 500 pts | 29.9% | £0 | Eligibility checker; vouchers auto-posted up to 3×/yr. |

| M&S Rewards Credit Card (M&S Bank) | 1 point/£1 at M&S (promo: £5 vouchers per £100 for first 6 months) | 1 point/£5 elsewhere | 23.9% | £0 | Up to 55 days interest-free if paid in full; eligibility checker. |

| Tesco Bank Clubcard Credit Cards (Tesco Bank) | 1 extra point/£4 at Tesco (on top of Clubcard); enhanced fuel points | 1 point/£8 outside Tesco | 10.9% (Low APR card example) | £0 | Same Clubcard earn structure across Tesco cards; Low-APR variant available. |

| Asda Money Credit Card (Jaja Finance) | Asda Pounds ~0.75% back at Asda (card app shows balance) | Asda Pounds ~0.2% back elsewhere | 29.9% (typical) / 29.9% rep. in recent docs; Select card up to 39.81% | £0 | Issuer Jaja Finance; clear fees shown in summary box PDFs. |

| Nectar Credit Card (American Express) | 3+ Nectar pts/£1 at partners when combined with Nectar card/app | 2 pts/£1 general spend | 36.1% (fee £30, £0 in year 1) | £30 (first year £0) | Strong earn if you shop Sainsbury’s/Argos often. |

Conclusion

If you shop at John Lewis or Waitrose, the points and automatic vouchers come with John Lewis Credit Card.

The online eligibility check is quick and helps you avoid an unnecessary hard search. Review your APR band, confirm fees, and set a Direct Debit on day one.

Use the app to manage spending and keep your rewards on track.

Disclaimer: This article is informational. Rates, fees, rewards, and eligibility can change. Your outcome depends on credit status and affordability checks by NewDay Ltd. Always review the current Summary Box and Credit Agreement, and consider independent advice if needed before you apply.