Applying for a Bank of America loan is now faster and easier thanks to their fully digital process.

You can explore different loan options, check your eligibility, and submit your application online without visiting a branch.

This guide will show you how to apply, what you need to prepare, and how to manage your loan efficiently.

Understanding Bank of America Loans

Bank of America offers a range of loans, including personal, auto, home equity, and small-business loans, to meet different financial needs.

Each option provides flexible repayment terms, competitive interest rates, and a secure online application process for convenience.

Eligibility Requirements

Before applying for a Bank of America loan, you must meet several eligibility criteria to ensure approval.

These requirements confirm your ability to repay and help the bank assess your financial stability.

- You must be at least 18 years old and a U.S. resident.

- Have a valid Social Security Number (SSN) or Tax ID.

- Maintain a stable income source with verifiable proof.

- Present a good credit score—usually 670 or higher for most loans.

- Provide employment or self-employment details.

- For secured loans, be ready to offer collateral such as a vehicle or property.

- Keep an active Bank of America account (recommended for faster processing).

Step-by-Step Guide to Applying Online

Applying for a Bank of America loan online is straightforward and can be completed in just a few minutes.

The process is designed to help you review your options, securely submit your details, and track your loan status from start to finish.

- Step 1: Go to the official Bank of America website or open the mobile app.

- Step 2: Choose the loan type that best fits your needs, such as a personal, auto, or home equity loan.

- Step 3: Enter your personal and financial details accurately in the online form.

- Step 4: Upload the required documents like ID, proof of income, and employment details.

- Step 5: Review your application summary and confirm submission.

- Step 6: Wait for email or app confirmation regarding your loan status and approval decision.

Documents You’ll Need

Having your documents ready before applying makes the online process smoother and faster.

These records help verify your identity, income, and financial background for loan approval.

- Valid identification, such as a driver’s license or passport.

- Proof of income, like pay stubs, W-2 forms, or recent tax returns.

- Employment verification from your current employer or business records if self-employed.

- Bank statements from the past few months to confirm financial stability.

- Credit information or reports showing current debts and payment history.

- Collateral documents (if applying for a secured loan), such as a vehicle title or property details.

Loan Calculator & Tools

Using digital tools helps you plan your finances before applying.

The loan calculator and online resources make it easier to estimate costs, compare options, and choose the best repayment plan for your budget.

- Loan Calculator: Estimate monthly payments based on loan amount, term, and interest rate.

- Rate Comparison Tool: View different rates for personal, auto, or home equity loans.

- Affordability Checker: Helps you understand how much you can realistically borrow.

- Prequalification Tool: Lets you check eligibility without affecting your credit score.

- Payment Scheduler: Assists in setting up automatic payments for better management.

- Customer Dashboard: Tracks application progress and loan balance in real time.

Interest Rates and Repayment Terms

Knowing the interest rates and repayment terms helps you plan your payments wisely.

These details show how much you’ll pay monthly and how long repayment will take. Here’s a short list of what to expect before applying.

Interest Rates

- Rates vary by loan type, credit score, and market trends. Example: an auto loan may start at 5.84% APR for a 60-month term on a $29,000 loan.

- Fixed-rate loans keep the same interest rate throughout the loan term.

- Variable-rate loans can change after a set period, possibly increasing your monthly payment.

- Some tools indicate that existing customers or those in a rewards tier can qualify for rate discounts.

Repayment Terms

- For auto financing, the bank offers terms of 60 months (5 years) or other lengths, depending on the vehicle and whether it’s new or used.

- Business term loans can run up to 10 years, or 15 years for real estate, while equipment loans usually last 4–5 years.

- Adjustable-rate loans (ARMs) start with a fixed rate, often for 5 years, then adjust every six months or as scheduled.

Tips to Improve Loan Approval Chances

Improving your approval chances starts with preparing your finances and maintaining a strong credit profile.

Taking a few simple steps before applying can help you qualify faster and secure better loan terms.

- Credit Report: Review it for mistakes and correct them to boost your score.

- Debt Reduction: Pay off existing balances to lower your financial risk.

- Stable Income: Keep consistent earnings and provide clear proof of employment.

- Limited Applications: Avoid sending multiple loan requests in a short time.

- Accuracy: Enter correct details on all forms to prevent delays or rejections.

- Prequalification: Use this option to check if you qualify without affecting your credit score.

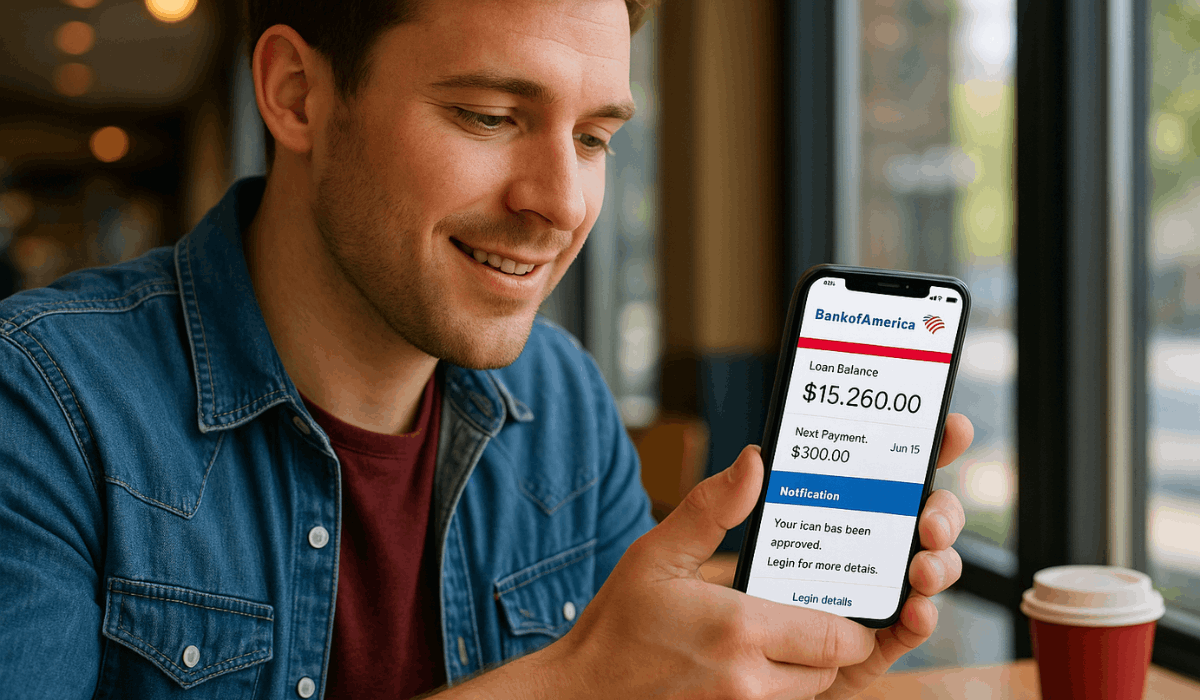

Tracking and Managing Your Loan Online

Once your loan is approved, managing it online helps you stay organized and avoid missed payments.

Digital tools make it easy to monitor balances, track due dates, and access account details anytime.

- Online Dashboard: View your loan balance, payment history, and upcoming due dates.

- Mobile App Access: Check your account, make payments, or set reminders on the go.

- Automatic Payments: Set up recurring payments to ensure timely repayment.

- Account Alerts: Receive notifications for payment confirmations or approaching due dates.

- Statement Downloads: Access and download monthly or annual loan statements for records.

- Customer Support Chat: Use live chat or secure messaging for questions or account assistance.

Pros and Cons of Bank of America Loans

Here are the pros and cons of Bank of America loans, listed to help you compare before you apply.

Pros:

- Wide selection of loan types (personal, auto, home equity, business)

- Competitive interest rates for eligible borrowers

- Discounts available for existing banking or rewards program members

- Strong digital tools for applying, tracking, and managing loans

- Nationwide branch and ATM access for in-person support

Cons

- Best rates often require very good credit (e.g., 740+ for mortgages)

- Some products have limited transparency on fees or APR values

- For business loans, you may need several years of operation and a personal guarantee

Customer Support and Contact Information

Below are key contact details for reaching customer support at Bank of America:

- Auto loans (new customers): 844-892-6002

- Auto loans (existing customers): 800-215-6195

- Mortgage & home-equity (existing accounts): 800-669-6607

- Mortgage & home-equity (new home-equity applications): 800-779-3894

- Business financing/loans: 866-543-2808

Conclusion: Apply Smart and Confidently

In conclusion, applying for a Bank of America loan online offers convenience, transparency, and control over your finances.

By preparing your documents and understanding the terms, you can ensure a smooth approval process.

Apply now through the official Bank of America website to start your application securely and manage your loan with ease.

Disclaimer

Loan approval, terms, and interest rates depend on your credit profile, income, and financial history.

Always verify the latest loan details directly on the official Bank of America website before applying.