Getting paid early helps you manage expenses without waiting for payday.

With the receive advance salary using the EarnIn App option, you can access the money you’ve already earned instantly.

Just connect your bank, verify your job, and request the amount you need with no credit checks or interest.

What Is EarnIn and How It Works

EarnIn is a mobile app that lets you access part of your paycheck before payday without taking a loan.

It connects to your bank and tracks your work hours to release earned funds safely.

Once your account and job are verified, you can withdraw funds directly from your paycheck balance. Here’s how it works:

- Download the App: Install EarnIn from Google Play or the App Store.

- Create an Account: Sign up and provide your employment details.

- Link Your Bank: Connect your checking account where paychecks are deposited.

- Verify Work Info: Confirm your job using GPS, timesheets, or a work email.

- Check Available Amount: EarnIn calculates how much you can withdraw.

- Request Cash Out: Choose an amount and transfer speed (free or instant).

- Automatic Repayment: The app deducts the advance from your paycheck on payday.

Eligibility & Requirements

Before you can access early wages, you need to meet specific eligibility criteria.

The section below outlines the key requirements for using the Earnin service.

- You must be 18 years or older.

- You must reside in the United States (or U.S. territories).

- You must have a U.S. bank checking account (not a savings or prepaid account) and use it for your paycheck direct deposit.

- You must have a consistent pay schedule (weekly, biweekly, semi-monthly, or monthly).

- You must be employed and have either a fixed work location or an employer-provided email, a timesheet, or some other verification of employment.

- The app does not support income from SSI, disability pay, unemployment, or veterans’ benefits alone.

Step-by-Step: How to Receive Your Advance Salary

Once you’ve met the basic requirements, you can start using EarnIn to access your earned pay before payday.

The process is simple and takes only a few minutes from setup to cash out. Follow these steps to receive your advance salary:

- Download and Install the App: Get EarnIn from Google Play or the App Store.

- Create an Account: Sign up using your name, phone number, and email address.

- Link Your Bank Account: Connect the checking account you receive your pay in.

- Verify Employment: Confirm your job using a work email address, GPS location, or a digital timesheet.

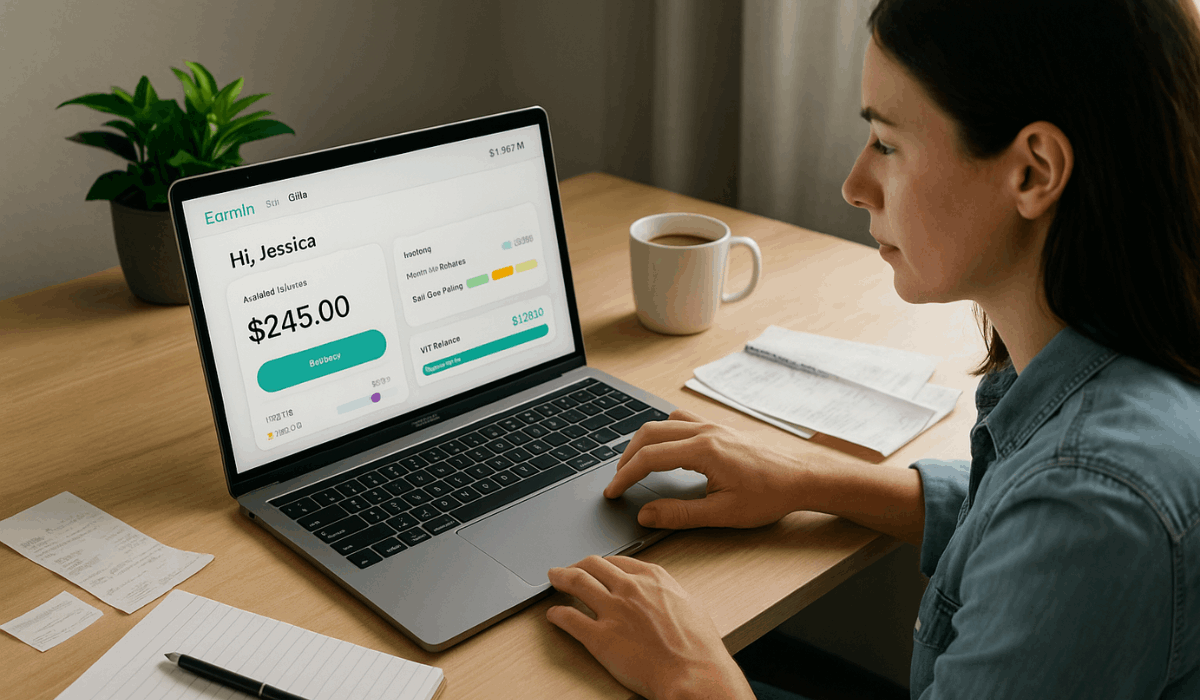

- View Available Balance: EarnIn calculates how much you can withdraw based on your hours worked.

- Request Advance Salary: Select the amount you need and choose your transfer speed — standard (free) or Lightning Speed (instant, small fee).

- Receive Funds: The requested amount is deposited into your linked account.

- Automatic Repayment: On payday, the app automatically deducts the advanced amount from your paycheck.

Fees, Tips & Repayment Details

Understanding how EarnIn handles fees, tips, and repayments helps you manage your money wisely. Here are the main points explained:

- No Mandatory Fees: EarnIn doesn’t charge hidden fees or interest for standard transfers (1–3 business days).

- Lightning Speed Fee: A small optional fee ($2.99–$5.99) applies if you want instant cash-out.

- Optional Tips: You can choose to leave a voluntary tip when withdrawing, but it’s never required.

- Automatic Repayment: The app automatically deducts the borrowed amount plus any tip from your next payday.

- Failed Payment: If your account balance is low on payday, your bank—not EarnIn—may charge an overdraft or NSF fee.

- EarnIn Card Fees: If you use the EarnIn card, standard ATM withdrawal or access fees may apply.

- No Credit Impact: Using EarnIn doesn’t affect your credit score since it’s not a loan.

Security and Data Protection

EarnIn keeps your financial data secure through multiple layers of protection. Here are seven key security and data protection practices you should know:

- Data Encryption: Your personal and banking details are encrypted during storage and transmission.

- Regulatory Compliance: EarnIn complies with major privacy laws, including the CCPA and GLBA, to protect user data.

- Secure Infrastructure: The platform uses advanced security tools to prevent hacking or unauthorized access.

- Limited Data Sharing: Information is only shared with trusted partners needed for payment processing.

- Transparency Policy: EarnIn clearly discloses what data it collects and how it uses it in its privacy policy.

- Bug Bounty Program: Security researchers can report vulnerabilities to strengthen the app’s safety.

- User Responsibility: Use strong passwords, avoid public Wi-Fi, and monitor your account regularly.

Integration With Financial Tools

EarnIn doesn’t just give access to your earned wages. It also integrates with other financial tools to support budgeting, savings, and bank balance monitoring.

- Balance Shield Alerts: Sends notifications or automatic transfers when your bank balance drops below a set threshold.

- Early Pay / Live Pay: Lets you receive your paycheck early or stream pay in real time, integrating with payroll or wage-tracking systems.

- Financial Calculators: Built-in calculators (budget, loan payoff, student loan, mortgage) help you plan your finances.

- Credit Monitoring: Provides access to your credit score and enables you to track it alongside your wage-access activities.

- Payroll/HR Integrations (Employer side): For businesses, EarnIn offers smart integrations with payroll providers to simplify the delivery of wages early.

- No-Integration Option (Direct to Consumer): You can use EarnIn’s tools without your employer’s payroll system being involved, making it flexible.

- Savings Tools (“Tip Yourself”): EarnIn automatically transfers funds or “tips” toward savings using your paycheck data and linked accounts.

Benefits and Risks

Here are the main benefits and risks you should know when using advance salary services like EarnIn so you can decide if it’s right for you.

Benefits

- Early access to earnings: You can withdraw part of your already-earned wages before payday, increasing cash flow.

- Avoid credit checks and interest: Because you’re accessing wages you already earned, it’s not treated like a loan.

- Helps avoid overdraft/late fees: Accessing funds early can prevent bank overdrafts and late payment penalties.

- Improves budgeting flexibility: By choosing when you access your money, you can better manage unexpected expenses.

Risks

- Potential debt dependency: Regularly using advances may lead to reliance on them rather than savings, creating a cycle of early withdrawals.

- Overdraft or insufficient funds risk: If your account doesn’t have enough to cover deductions when payday hits, you may face bank fees.

- Regulatory and fee uncertainty: Some states and regulators view the fee/tip structures as high-cost credit; rules may change, and costs could increase.

Tips for Responsible Use

Here are key tips to help you use the EarnIn app responsibly so you can benefit without risking your finances.

- Advance only what you can repay. Make sure the amount you withdraw is affordable to repay when your paycheck arrives.

- Leave a buffer in your bank account. Keep enough funds for other bills and avoid overdrafts when repayment happens.

- Use standard transfer when possible. Choose the free 1–3 business day transfer unless you genuinely need instant funds.

- Track your spending and budget. Know how much you make, spend, and owe so you don’t rely on advances too often.

- Build an emergency fund. Use savings to cover surprises rather than relying on wage advances.

- Monitor your repayment schedule. Be aware of when the next paycheck comes and when the deduction will occur.

- Avoid making advances a habit. Frequent use can lead to dependency and weaken your financial stability.

To Conclude

Using the EarnIn app gives you more control over your income by letting you access your wages before payday.

When managed wisely, it can help you handle expenses and avoid unnecessary debt.

Start today and experience how receiving advance salary through the Earnin app can make managing your money easier and more flexible.